The HTS Story

This is a story of the transition from entrepreneur to employee. I spent over 40 years as my own boss before moving to a role as an employee at ConnectWise, now over 6 years ago. And as I looked for some history to share, I discovered that this part of the story hadn’t been written down yet – at least that I was able to find. There are a few presentations with pictures and facts, but not a story. So here goes…….

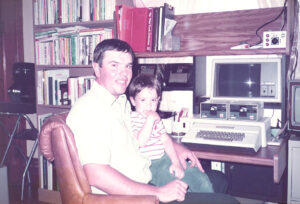

The journey was from farmboy, where I worked side by side with my dad and brother, to developing a love for computers that led to a hobby business. But before there even was a business, let’s look at what happened that caused me to be smitten with the technology bug.

During my time in high school I was exposed to the one computer our school had which resided in the math lab. It was very basic, but I was enthralled so would hurry through my work so I could get a few minutes trying to program this amazing machine. Our math teacher (who later became an employee at HTS and HTS Ag and still works part time for us) also took a few of us down to Creighton University in Omaha with stacks of punch cards to program their mainframe. Nothing I did was very elegant or useful, but it captured my desire to learn more.

At Iowa State, I never touched a computer in my short three-year stint in Farm Operations. So I returned home and wanted to continue to learn about computers. One of the math teachers at the middle school went to our church, so I asked if I could come in after school and ‘play around’ with a computer after classes. John graciously agreed and I did that a few times before I was convinced of the need to get my own to do our farm accounting on.

That was the excuse to convince my bride to make the over $4000 investment in our initial machine – a 64K green screen Apple II Plus with dual floppy drives and a dot matrix printer. I vividly remember the salesperson telling me it would be ‘all the computer you will ever need’. Wow, that was a sales job. But I was ecstatic in having a machine and dove in with both feet learning and becoming proficient with the system and software.

That was the excuse to convince my bride to make the over $4000 investment in our initial machine – a 64K green screen Apple II Plus with dual floppy drives and a dot matrix printer. I vividly remember the salesperson telling me it would be ‘all the computer you will ever need’. Wow, that was a sales job. But I was ecstatic in having a machine and dove in with both feet learning and becoming proficient with the system and software.

As farming neighbors heard about the machine, they would ask to come over and see it in action and between 1982 and 1985 I would load up a car with a couple other farmers and we’d head down to Omaha to pick up systems for them. I loved it so much that helping them set up and learn how to use it was fun, but soon it was becoming more than an occasional event so I decided it was time to figure out how to at least get something for the effort.

There was no intent at the time to turn it into anything more than a funding source for my addiction to technology and some extra money to use for fun. My first year in business, which I opened on Thanksgiving weekend in 1985, netted a bit over 10K in total sales. It was called The Computer Connection and certainly did not exactly begin with a flying start.

For the next 5 years it was me doing a little technology in the evenings, but over that time I helped a number of family, friends and neighbors purchase computers (mostly for farm accounting) and all the trimmings and soon figured out that it was becoming a lot more than a hobby as I spent too many evenings and then weekends doing work. Hobby does not equal work. It was decision time, and in 1990 my brother (farming partner) and I decided to incorporate a real business and make a run at it. He would do the farm stuff and I would focus on the technology and we would be equal partners in both. The company name changed to Sorensen’s Computer Connection Inc (SCCI) which remains today as our main holding company.

The working arrangement between Brad and myself would serve us well through a number of businesses over the years. The reason it worked was absolute trust in each other and it continues to this day. The work ethic instilled in us by our parents and the upbringing we had provided a foundation that we could focus on our own area and leave the other completely alone unless requested to dig in. Most families can’t function like this, but it has been a success factor for us.

I was an entrepreneur that had been let out of the hobby cage, and now my focus moved to trying to create a real business. It was slow going, because I really had no clue what I was up to. So in the first five years of the 90’s we grew from one (me) to five – a couple engineers, a trainer, and a service technician. I am proud to say that two of the five are still here working alongside us today. So you can’t call my growth path impressive – more accidental and figure it our as we went. I was a typical muscle and feel entrepreneur. No real plan, just get up, work hard every day, and hope for the best.

We had no idea what good looked like and had no concept of best in class. But I was full of ideas and with the success we had experienced, I was ready to go for it. Our model during those years was pretty simple – we had a training room – an addition built onto my house (#2 of 5) that was set up with three rows of tables – 18 workstations in all. My trainer Brenda and I taught classes four nights a week rotating every other day with different classes. She focused mostly on Microsoft Works (word processing, database and spreadsheet) while I focused on farm accounting and other systems.

If we managed to get them into a class, they almost always bought a computer. And being located in a cornfield in rural Iowa, there was little to no competition for computer classes, so we were almost always full. So sell our 10 week class to 8-10 families and then spend the next 10 weeks installing a computer system each week while we taught the next class. It worked beautifully until we began to expand into business networking and other applications which is where the network guys – Brian and Randy – came into the picture. Connie soon joined and handled more of the technician and service management chores, and we went comfortably through 1994 without truly understanding what lie ahead with the dawning of 1995.

It began as any other year, but 1995 became a year of massive change as Microsoft entered the computer space with a game changing release – Windows 95. It was the first operating system that was easy to navigate by normal users, and immediately drove demand for computers and what they could do.

We began to gear up by adding building addition #3 that year, which gave us an area we set up with cubicles to provide working space for our team along with the classroom we were still using. We also began getting ready to hire and by the end of that year and completed our first decade growing from one to five people.

1996 started with a bang as the Windows 95 frenzy took over and demand soared. Throughout the year we grew to thirteen people from the five we began the year with. To say that taxed our systems (or lack thereof) would be an understatement. It was chaos. Almost all the knowledge was in someone’s head, and there was no way to transfer that to anyone else except through a conversation.

I did a couple things that were critical as we closed that year – hiring someone to help with HR and customer relationships, as well as taking one of our engineers with a propensity to programming and database management, and beginning to build a tool to keep information on the work we needed to do and track it. (Today we call that a PSA tool – professional service automation) but at the time we just knew we needed some way to keep track of what was happening and needed to be done besides paper and memory.

The company continued to grow, and in 1999 we had reached nearly $4M in revenue. Our sales mix was primarily hardware with some break fix services, installation and project delivery. That number became a menace to me, because it turned out to be a ceiling that we hit for the next three years. That would turn out to be a motivator to tackle growth through M&A, but there were a few bumps before we got to that in 2003.

HTS grew as a services/engineering led company. While I was never a high-end engineer, I was a decent technician and did networking as well. Lantastic was our initial entry before Windows 3.51 came out. My attitude was we didn’t really need salespeople, and actually said as much to the team during our growth years. Those were words I would later eat, as it was one of the major reasons our growth stalled, but I didn’t figure that out until later on the journey.

In 1999 I determined the way to blast through the ceiling was to prepare for the greatest event in the history of technology – Y2K. We hired an additional dozen or so folks to prepare for the expected onslaught of business and when the clock turned and we entered a new century, Y2K missed Iowa completely. It was obvious within a few weeks that we had way too many people for the work that was coming in the door. It quickly became a financial burden and honestly, I did not know what to do. We had never let anyone go before, and certainly not the dozen extra people we had on payroll.

It was in March of that year that one of my leadership teammates suggested to get together with some other peers across the state and see what they had experienced. It was a brilliant suggestion, and we called three companies and asked them to join us in Des Moines for a half-day session to compare notes. They all showed up. We spent the entire day and learned that no one had any real opportunities from Y2K. While that in itself was helpful, the information gave us the confidence to go back and downsize immediately. Had we not had that validation it likely would have been months longer before it happened. It literally may have saved the company. It proved the power of peers and was the start of Heartland Tech Groups (HTG) which grew from that meeting.

We continued our journey and were stuck around that $4M mark. In 2001, I had hired a COO that was scheduled to take on my role of president in an effort to build a team that would be able to acquire in order to blow through our ceiling. John joined and helped negotiate our first acquisition along with a lot of other maturity actions to prepare us. He helped me understand that we had to build a sales engine if we were truly going to not only grow but remain relevant. It was all on track when he asked me to take a walk one October afternoon and announced he was leaving. That was a dark day in my world as I was so looking forward to handing some responsibilities to him. It would be seven more years before I found the next person I would trust to take the reins.

Before we go forward, it’s important that we pause and review the other things that happened between 1995 and our first M&A in 2003. As a serial entrepreneur, it wasn’t that I cried uncle to the revenue ceiling that settled in. We tried a lot of things to try and expand our markets and create ways to continue growth in our region. I wasn’t going to let this glass ceiling stifle my entrepreneurial spirit.

During these years, we opened satellite offices in five communities in the Southwest Iowa area. (Red Oak, Denison, Harlan, Audubon and Missouri Valley). We even tried a Christmas kiosk at the Mall of the Bluffs in Council Bluffs. These were all towns in the 5-10 thousand resident size, and each less than an hour drive from headquarters on the farm. We co-located with other businesses in those communities as we didn’t have our own full-time staff there every day and didn’t want the cost of brick and mortar. We viewed them as service depots and would have someone onsite for scheduled times each week to do repairs, meet with sales opportunities and transport equipment with significant issues back and forth to the farm.

During these years, we opened satellite offices in five communities in the Southwest Iowa area. (Red Oak, Denison, Harlan, Audubon and Missouri Valley). We even tried a Christmas kiosk at the Mall of the Bluffs in Council Bluffs. These were all towns in the 5-10 thousand resident size, and each less than an hour drive from headquarters on the farm. We co-located with other businesses in those communities as we didn’t have our own full-time staff there every day and didn’t want the cost of brick and mortar. We viewed them as service depots and would have someone onsite for scheduled times each week to do repairs, meet with sales opportunities and transport equipment with significant issues back and forth to the farm.

These were low-cost operations from a cash outflow perspective, but even having some supplies and basic repair capabilities added up. I spent many a day driving from the farm to these sites to meet with clients and prospects and fix equipment. They sort of worked, but small towns like to do business with companies that are rooted and committed to their community, and we didn’t quite pass the smell test on that. We dropped in and were gone until next week. We didn’t attend their activities and events day to day and were not viewed as being part of the community. We used this strategy for a handful of years, but it ran out of gas and we put our energy toward M&A.

We also took a partnering approach, creating partnerships with a local print dealer (Bro Business Center) as well as some members of Ingram’s VentureTech Network (now TrustX Alliance). Both of those were beneficial, but we did not have adequate people to leverage the opportunities as effectively as we should have. Amazing what you see when you reflect back as partnering is definitely a solid growth strategy when done well.

As a serial entrepreneur, shiny objects definitely caught my attention during this period. In 1995 a local farmer who was a client of SCCI for computers, had a keen interest in GPS technology and imagery. So like any good entrepreneur, we spun up a business (Western Iowa GPS) together to capture and deliver infrared and NDVI images with GPS location tied to those views. We hired three agronomists and built a photography platform to fly across fields capturing images for use in crop scouting and problem identification. It seemed like a brilliant idea.

Our first problem was a lack of an airplane. This was well before drones, which now make this a simple and regular option. I had a client at SCCI who had a plane and interest in a family farm in Nebraska. We sold him on the concept and convinced him to let us cut a hole in the bottom of his plane. He also had a part time pilot and flew one of our team all over the Midwest gathering images, which at the time had to be put on CD’s as the file sizes were huge, and storage was a challenge. We had piles of CD’s that we never were able to sell. After a couple years of trying, we disbanded WIGPS and sold the precision technology assets to SCCI which started a precision tech group which later was spun out as HTS Ag which continues to operate today as a stand-alone company on the farm.

In 1998 we created a division within SCCI called Rasnet which was focused on helping ISP’s deliver Internet services to their clients. That’s right – the Internet did not always exist as you know it today. This was a very high demand operation as downtime was frowned upon so it was a 24/7/365 business which we were not equipped nor staffed to handle. It had a limited customer target, so much of the work required travel and moving large sized racks and technology many miles away. It actually was a profitable division until the Internet became more established and large providers came in and took over much of the market.

During that same era we got the idea that since we had over two dozen cars on the road for our service team to go onsite, having our own auto repair shop made sense so we spun up a division of SCCI called SCCI Automotive. At least it did on paper, if you create the model with unrealistic numbers and ignore the real costs of setting up shop. On the farm we had a large shop area available, so how hard could it be. Very hard, and after beating our head against the wall for a few years we realized that servicing cars and trucks was necessary, but not a business we should be in.

Serial entrepreneurs often swing for the fences, and I was no exception to that either. In the late 90’s we hired a real salesperson who did a sales job on me, convincing me to open a farm equipment division at SCCI. We called it Midwest Ag, and unlike the SCCI Precision Technology division which focused on GPS technologies costing thousands of dollars, Midwest Ag was selling large scale equipment costing tens to almost a hundred thousand dollars. He convinced me of the amazing ‘first to market’ opportunity, and it didn’t take long to create a major cash problem as we tied up dollars in inventory that we needed to cashflow the business overall.

The only good news from this experience was his ability to sell as he did manage to turn equipment so we didn’t take a significant financial bath, but after a few years of living on the edge it was obvious to me that farm equipment is a big boys game and we were a baby in comparison. I lost more sleep over that division than almost anything else during my entrepreneurial journey.

There was one other company we spun up during this window of time – ugliestshirts.com. I have always been a believer that what you wear can make an impact at trade shows and events. My bride wishes I would have that attitude about my everyday apparel, but it seemed obvious to me there was a big void in the loud and almost obnoxious shirt market. So we created a number of amazing designs which I required my team to wear whenever we attended any event or activity that others would notice. That was not a popular directive, but they held their nose and did it for me.

No one can dispute that the shirts were noticed. Unfortunately, that led to smirks and comments, but definitely no sales. Well a few to others with a little twisted minds, but mostly it became something fun we did and used to keep our team loaded with company apparel. I have a closet full of those designs in waiting, hoping that someday this idea will get real legs and become what I dreamed it would back then.

I share these stories to make an important point. Taking risk is part of business growth. As a serial entrepreneur, I lacked the risk control gene, but doing things that don’t work is part of business. You have to learn to try things and fail fast if they won’t work. They become lessons learned and are only a mistake if you fail to learn the lessons they can teach you.

It’s important to be transparent about a half dozen things that were at best a distraction, but in reality, cost us time, talent and treasure. They didn’t really help us break through our glass ceiling, but in all likelihood were responsible in some ways for keeping us there.

We’ll continue the story of the SCCI/HTS journey. It’s 2002 and we are on track again to hit $4.5M in revenue for the fourth year in a row. I was frustrated and determined to break through that ceiling but had proven very well that doing the same things we did last year wasn’t going to get it done.

We did a couple small acquisitions to test the waters. One was a single person organization in another town 45 minutes north of us. It wasn’t so much the competition as a continual annoyance in that market. He wanted out and it wasn’t going to cost much, so we bought the business, closed it down and kept a few of the good clients. The value was getting rid of the distraction in the market.

We acquired a second small company in another town about 60 miles away in order to bring on the owner and her two technicians. This was a talent grab but what we didn’t know (because I did no due diligence) was that the techs were under no sort of non-compete or non-disclosure agreement and upon acquisition opened their own company and competed with us directly in that same market. We did bring on the owner who helped us maintain most of the customer base, but our effort to add more technical resources didn’t work out in reality as it did on paper.

As part of Ingram’s VentureTech Network we had developed many strong relationships with other company owners across the country. One of those

As part of Ingram’s VentureTech Network we had developed many strong relationships with other company owners across the country. One of those

was Connecting Point Joplin led by Jane Cage. We often joked with each other about selling to the other at meetings we were at together, but during the summer of 2002 we actually started to talk with a much more serious focus. Over the previous couple years we were doing some joint selling with CPJ implementing document imaging systems into our customer base and SCCI installing IP telephony systems into their base. That worked pretty well and we crept ever closer to having real conversation around a potential merger.

I readily admit that I was ineffective in two key areas to successful growth – financial management and sales. Connecting Point Joplin had Jane (a financial genius) and Larry Hedin (a sales master) which were exactly the two areas SCCI needed help with if we were going to grow. We met to talk about the possibility at a casino in Kansas City which was halfway between the two companies. During that visit, we roughed out the possibilities and soon began the process of developing an integration plan with a January 1, 2003 start date for the new combined entity – Heartland Technology Solutions (HTS).

Actually picking the name was one of the more difficult parts of the entire process. We basically threw all our chips into a shared bucket and combined assets in a non-cash transaction. SCCI remained the parent company but DBA’d as HTS. And we were off to the races. For the first year I had committed to at least one week a month in Joplin, and Jane the same for Harlan. Looking back over all our M&A experience – that was a definite factor in our success as we got well acquainted with all employees and were able to learn the customer bases and regions quickly.

A few months after our merger, I got a call from another VTN member from central Iowa who wanted to sell his company to me due to illness. They were primarily a MAC shop which wasn’t really anything we were currently doing, although that was the roots of my technology beginnings. We kept talking and by summer were owners of an Apple shop in Ames, Iowa. Since I graduated from Iowa State located there, it was a great fit and I enjoyed the opportunity to head to Ames regularly. My bride and I rented an apartment there for the second half of 2003 to make sure that integration went well so most of our life the rest of the year was spent in Joplin or Ames. But both kids were in school at ISU so it worked out well.

The lead salesperson whom we gave the role of location manager to didn’t like the changes we were making. He couldn’t really argue or lead differently when I was working from that office, but as soon as I left he would tell the team to go back to how they used to do things and ignore the new systems and processes. Early in 2004 it became obvious he was undermining our efforts to integrate the acquisition, and we faced a major dilemma. Do we fire the lead salesperson who was driving the majority of the revenue for that location?

Our new leadership team agreed it had to happen, so I vividly recall the discussion when I called him into my office and told him he was being let go. He looked at me with amazement and said “you can’t do that” to which I said “I just did”. He told me the place would fall apart and be closed in a matter of weeks, and I wasn’t so sure he would be wrong. But we knew that he was cancerous to our culture and it had to happen. He left, employees came in and asked what took us so long, and it became one of our best producing offices in the company through the years.

Culture matters. You need to have well defined mission, vision and core values and you must hire, fire, compensate, retain and reward people based on your culture. Any time we strayed from that we suffered some pain and it cost us both money and human capital.

We navigated 2004 with a year under our belt operating the merged and acquired entities with no real disruption. We were now a $6.3M company (finally blew through that ceiling) with 43 employees as we entered a new year.

2005 proved very interesting from a personal perspective. Early in January I was out scooping snow and felt pressure in my chest. It actually wasn’t the first time it had happened, but it was the first time I opened my mouth and mentioned it to my bride. And for exactly the reason I had never said anything before, we were in the car headed toward the hospital within minutes.

I had dismissed it as being out of shape, or just heartburn or any other number of excuses. But after getting to the ER it was a short time before I was with the visiting cardiologist who happened to be working in Harlan that day. She had me on the treadmill for a stress test and within 30 seconds commanded me to get off and lie down immediately. That was a signal that something wasn’t quite right, although I had no clue how wrong it would be.

That was on January 7, 2005. The cardiologist diagnosis was a clogged artery that would require a stint or balloon. I negotiated admission to Creighton Medical Center on Monday January 10, as I had planned a full weekend ahead. Probably not my brightest sales job, but she took the logic and agreed I could check in after a full weekend of activity.

They wheeled me in for a stint and I was back in the room rather quickly. The surgeon had gone in and pulled back out without making any repairs. There were multiple blockages in all the major arteries, and the cath surgery was not able to fix things. Blockages were 80% in one and 90% in the other three, and the stream of doctors began to come in and discuss the next option – bypass surgery. They rushed to schedule the operation which didn’t fit for a couple days.

The lights went out on me in the surgery prep area around 8:30 AM on January 12, 2005 and I remember very little until the next day. Nancy tells me they woke me up very slowly, and the tube came out of my throat before I was awake, which is a good thing. They had done a quadruple bypass on my heart, and it took much longer than expected. There were wires everywhere. My back was killing me – felt like I had been tied up in a knot.

All the wires were tangled, and I could hardly move. I had a long talk with God about Paul’s words in scripture – “to live is Christ, to die is gain”. I actually felt that dying might not be a bad plan and wasn’t sure that this decision was the right one. I was really in the dumps from an attitude perspective.

God was gracious and I began to recover and once the chest tubes were removed over the weekend and I was able to get up and out of bed, my view on life improved. It was a definite shock to the business as we were in no way ready for the CEO to be in the hospital facing serious medical outcomes.

We had no plan for this situation. I was not prepared from a legacy planning perspective and we were so focused on growth our team had never slowed down enough to put the right documents and plans in place to address what could have been a very different outcome. Jane and Larry came to see me, and I was definitely feeling like I left them in a very difficult spot having to take over all the management without any plan or preparation.

I was released after a week or so, and because of how poorly prepared we were, I had my brother secure a hospital bed and set it up in our family room which was through a door from my office. Remember that the office was built on the south end of my house, so it literally was a door between the two. For the next weeks I spent my time in that hospital bed meeting with my team answering questions and trying to provide some direction between rehab and resting.

It was less than ideal, but the reality of what happens when there is no plan, no management structure, and little documentation to provide direction. I was still overseeing the service delivery side of the business and overall leadership duties, and the team was wondering what the future of HTS would be. It is not a model I recommend.

Somehow people stepped up (which they always do) and proved that we could operate just fine without me being in the middle of things. I spent most of three months recovering and with each passing day was less necessary in the day-to-day operations. This experience is what spurred me to really dive into life and legacy planning which became core to HTG. There is no better teacher than the school of hard knocks, and I got a real lesson on this one.

The rest of the year we really stayed fairly flat, which felt like a win from my seat. I was fearful of much bigger challenges, but the team responded well and after the initial shock wore off, they dug in and made IT happen. That was our marketing slogan for HTS – Making IT Happen – and the team did exactly that even without my direct oversight and management. It was a great lesson for me and validated the need for me to focus on strategy and leadership and let the experts run the company day to day. That was plenty of excitement for one year.

As we prepared to grow, brother Brad and I did some legacy planning and made our kids shareholders in the late 90’s before we determined M&A would be our path. So we went from the two of us holding 50% each, to adding our five kids (3 of his and 2 of ours) as shareholders. Seemed brilliant at the time, but of course as we began our M&A journey it became more complicated.

We added two more shareholders with the Connecting Point Joplin acquisition in 2003 bringing us to 9 shareholders. And now in 2006, we decided to bring on another merged company – BCC in Wichita, who came with five additional shareholders from the two acquisitions they had done previously bring us to a whopping 14 shareholders when we completed the deal that summer.

One lesson I’d share is when to do acquisitions versus mergers. The driver for many mergers is a desire to spend little or no money. You put all your chips together and form a merged company with no cash outlay. It’s the inexpensive way to bring companies together, but like a marriage, it is much easier to get into a combined company than to get out. So never to a merger UNLESS you are doing it to bring in talent you need to continue your growth path. There is absolutely no reason to complicate your ownership structure with people that are not critical to the company. Because once an owner, always an owner as downgrading them to employee status just doesn’t really work.

So the lesson is never do a merger without an extremely compelling reason. We found that in 2006 with the BCC merger and we brought on a COO in Kelly to help round out our leadership team. It was a huge acquisition for us. We had grown HTS to $8M plus but added another almost $7M in revenue taking us to over $15M. But we also added four more locations to the three we already had and two more states (KS and OK) so we were all of a sudden in four states with 75 employees.

We learned a lot about how not to make assumptions in this merger. You know the definition of assumption right – it makes an ass out of you and me. It did, and I had egg on my face with several things that we didn’t discover in due diligence like we should have. We assumed the culture would be similar across the four locations and it definitely was not. They had brought together four companies that were not completely integrated, and then you bring them into a relatively new company of three other unique companies and all of a sudden you have HR and culture chaos.

The words ‘red headed step-child’ quickly became part of my vocabulary because every location outside of the Harlan headquarters all of a sudden felt like they were not getting the same resources and treatment. That was true as we couldn’t afford to go out and buy all new equipment or upgrade all the connections and networks at once. But employees got pretty picky about their expectations and felt ‘mistreated’ by the new big bad leadership team.

In all reality, headquarters probably had the poorest resources of all, but that truth didn’t matter because the perception was inequality and perception almost always trumps reality. We lost a number of the acquired team, particularly in Oklahoma and ended up dropping well over half of the 22 acquired staff over the first couple of years. Fortunately we maintained the business and the key folks and the customers. Another lesson I learned is that customers seldom leave if you communicate and provide quality service. That is not the case for employees as we experienced they often would leave for even the smallest reasons.

One of the most perplexing reasons I ever experienced was when we changed the date of pay from third and seventeenth to the first and fifteenth. We moved payday up two days in the month. Two employees left over that change – at least that was the reason they gave. The problem was that all their autopayments were set up to come out on those days each month, and by moving payday ahead two days they were fearful that the money would be spent before being auto drafted for payments and they would overdraw their accounts and incur costs. I’m not making this up.

Another left because we changed the credit card used for buying fuel and the station they were accustomed to using prior to acquisition did not accept the card we provided so they had to go to a station a few blocks away. They couldn’t make the switch because they had relationships with people that frequented that other station each morning and they would miss their coffee together.

My biggest mistake around M&A communication was saying ‘nothing will change’ which I only did one time because it got thrown back at me many times in that particular acquisition. Things will change – they have to – no NEVER say there won’t be any changes made because that statement will make you a liar.

The BCC acquisition stretched us in many ways, from leadership and management, to financial access to money, to relationships with vendors and distributors and more. Almost doubling our size with a pen stroke changed a lot of things and while it was a great growth strategy, we really had to work hard to integrate and get our hands around it.

One of the biggest fallacies of M&A from my experience is the formula that 1+1=3. While that can certainly be an outcome over time, we certainly did not find that to be the way it worked in the short term. Integration is the real difficult part of M&A. The deal itself is actually the easy part. Bringing together the companies is where the hardest work takes place. And while that is overwhelming, particularly in a large transition, it can’t stretch on for too long or 1+1=1.5 which is not the outcome anyone wants.

We got it done and had built a platform that we felt would enable us to scale and continue to expand into our four-state region which would soon become five states.

In the fall of 2004 I attended and spoke at SMB Nation in Seattle. One of the topics that was new and garnered a lot of discussion was this new concept of fixed fee managed services. The idea of providing unlimited technology service for a pre-determined price was unheard of in the small and medium business marketplace, but there was a lot of buzz about it at that show.

HTS was a value added reseller (VAR) that focused on selling hardware and then adding on project services to do the implementation and support. In the late 90’s we had began offering proactive services where we would preschedule and have an engineer make monthly health checks on client networks, and we also sold prepaid discounted blocks of service time, but that was as close as we got to any kind of managed service, and it certainly wasn’t fixed fee and unlimited.

But over the next few years, we began to discuss and then move toward a managed services model. In an HTG meeting in Madison in 2005, I recall a rampant debate over how one could possibly offer a service like that and not go broke. But we started that journey and would work to migrate our business toward that over the next few years. The major driver was a more reliable cash flow and higher gross margins on services once we got the pricing model right.

With the BCC acquisition in 2006, we poured gas on the fire and grew to 80 folks in 2007 and a few more in 2008. We were learning to transition our service model, but it was a slow process as we had 20 plus years doing things the old way.

We had a couple changes in 2007 when we acquired a telephony and networking company in Omaha and opened our first office across the Missouri River. We had done business in Omaha but those clients were served from the Harlan office and the more we attempted to penetrate the Nebraska side of the river, the more it became apparent that to succeed there we had to have an Omaha office.

Scott moved up from Tulsa from our Oklahoma office to open up shop for us in Omaha and he’s been living there since. Our strategy was to stay in tertiary markets and strike into the tier two cities from the outside. It was how we had been serving Omaha. We served Des Moines from our Ames office. We served Tulsa from our Muscogee office, and Springfield from our Joplin location. Wichita was our first move into a major city, although we had the Hutchison and Newton offices within an hour of the metro we could use. And we’d make our final acquisition a little later in St. Joseph to have access to Kansas City.

The acquisition in Omaha was a dismal failure as we didn’t understand that market, didn’t keep any of the staff, and didn’t really have time to invest in working the opportunity. We managed to keep a few premium clients but most of that acquisition fell by the wayside. It really wasn’t a very good investment, and we should have learned from it for future M&A activity.

2007 was our largest revenue year of all time as we peaked at $16.9M in top line revenue. We drifted down from there as we worked to shift our focus from selling product to migrating clients to managed services which definitely helped create a much stronger bottom line.

Beginning in 2007, the HTG peer groups began to grow. To this point I was facilitating three groups, but we had a pipeline list of about 60 companies and I decided to spin up groups utilizing the HTS executive team as facilitators. So we went from three to ten groups in 2007 and then to 18 groups in 2008. It seemed genius to me on paper.

Our leadership team would be exposed to lots of other companies and surely could do their full time day job and find time to facilitate a group, which soon became two and was taking multiple weeks each quarter with travel and group management. It was in the late fall of 2007 that Scott drew the short straw and was sent by the leadership team to explain just how unsustainable my brilliant plan was. They were of course correct, and we had to move to a member facilitator model which then allowed the leadership team to focus on running HTS again.

While this was my own created issue, I do see this in many companies. They run with an overburdened leadership team and then do things like an acquisition expecting their team to do the integration in their spare time. Here’s a newsflash – there is no spare time when the leadership team is already running at 110% capacity. So I relented and we got things back on track for HTS with a much healthier leadership team.

The next few years were focused on transitioning our business model which was a long and painful process. We did much more work remotely across the wire and needed more people on the team to get the work done. In 2010, we made our final acquisition in St. Joseph when we brought CNS into our fold. That gave us seven offices across five states and put a pin right in the middle of our territory.

The only problem was that the leadership team was worn out and not at all excited about travel. So the reality is that we did a very poor job of integration and onboarding the team there and certainly didn’t get the value we should have in the first year or two.

We did slowly begin to get the service model right, and by 2012 had grown to 102 people on our team, which immediately sent red flags up from our HR and legal resources as the rules changed after crossing the 100 employee threshold.

I fully admit I was worn out and struggling to stay focused and engaged on HTS. We were having a lot of success with our peer group program HTG and my time was being required in lots of places and the IT company didn’t get nearly the focus it needed. It was obvious to me that I was the limitation to growth and it was time to begin thinking about an exit.

Effective January 1, 2013, my world changed. The business that had been my life for 27 years and 35 days, was sold and a new chapter in my life began as we transitioned HTS from our portfolio of companies to WestTel Systems. It was in some ways a difficult decision, but in reality, it was very clear that God was leading me to this decision and gave clear guidance that it was His plan.

I’ve always seen HTS as something God entrusted to my care. It was given to me to nourish and grow and take care of. And that is how I have tried to run the company for the last 27 years, as a gift from God. I know it is not mine, nor something that I built. It is God’s and my role has been caretaker and trustee of what He provided. The parable of the talents in Matthew 25:14-30 has been a constant reminder that I have a responsibility to take that which has been entrusted to me and manage it well. I’ve tried to do that but know at times that I’ve failed. I have worked to take God’s blessing and steward it wisely to grow it into something more. He has blessed those efforts, and for that I am grateful.

There were a number of factors that led me toward being willing to execute a sale or transition:

- Consideration around number of employees on staff and impact of pending regulation and health care rules. (We were at 100+ and wanted to return to under 50)

- Stage of life for shareholders:

- Partner – ready to exit

- Shareholder families – 2 buying houses, 1 remodeling, 1 just returned from overseas

- Buyer approached with cash in hand

- Met all non-negotiable requirements

- My bride was supportive

- Leadership team was supportive

- I had lost passion for the business

- I was seeking God’s direction through prayer

Our initial discussions began during the summer of 2012, but it didn’t really become active until our first face-to-face meeting on Halloween day the end of October. That meant this deal had to be completed in basically two months’ time. I was very convinced that God’s plan was for a transaction that closed by Dec 31, 2012 and made that clear from the start. There were many times during those 62 days that the brokers offered up ways to extend that date – using escrow accounts, partial payment, deferred contract language and on the options went – but I was intent that if it was to be it had to be completed by the end of the year.

As part of legacy planning, I had crafted a list of ideals that would guide the transition of HTS into the future. I had considered a number of options:

- Sale to outside buyer

- ESOP

- Sell to key staff

- Hand down to family

- Just hang onto it and ride it into the sunset

I did a lot of study around an ESOP but the costs and the long-term challenges of winding it down seemed to make it an unlikely option. Selling to anyone except the market was surrounded with concerns by other stakeholders around the price calculation and getting paid cash. There wasn’t much interest in carrying paper or funding a transaction, so that limited most of the other options.

Some use Gideon’s approach to prayer. (Judges 6:36-40) Make a list and see if God will do something miraculous to assure a decision. Tempting as that is, I didn’t want to approach this as a fleece opportunity. Rather I prayed about the legacy requirements that God had led me to develop as part of planning done earlier. The fact that those things were in place and I knew what needed to be in place to provide the desired outcome, it made the decision simpler and took the emotion out of the situation when the opportunity presented itself. (Jeremiah 29:11) (Isaiah 43:19)

I wasn’t looking to sell. God laid this in my lap. A random broker from Des Moines called early in the fall and wondered if I had ever considered selling. I have had hundreds of calls like this over the last 10 years. I seldom spend any time with them because my screening question: “Do you plan to pay in cash?” usually ends the conversation. Most deals are based on a little cash and a lot of earn out. But one of our requirements was a mostly cash deal. That ends their interest most times – but not this time.

I brought it to the management team in late September, believing it just might happen. Everyone was interested. The time was right. We signed an NDA and shared some information both ways. Of course, I had interest in being sure they could actually acquire us. It isn’t a simple thing to do with the breadth of territory we covered and the number of staff we had. Payroll alone is enough to scare away many prospective buyers. Weeks went by and then in mid-October they asked for a face-to-face meeting. It happened on Halloween day in Harlan. The HTS leadership team sat down with the brokers and buyers leadership and we talked about what might be. I had a list of items that were requirements for a sale to occur. As we talked through them, it seemed like the deal had potential of meeting all of our requirements:

- Had to understand rural America and be committed to it

- Had to keep serving our markets during transition

- Had to keep our team intact

- Had to keep our leadership team in place

- Had to continue to provide benefits and take care of the team

- Had to continue to serve our clients – cannot cherry pick

- Had to continue to sell the products and services we sell

- Had to be a platform acquisition

- Had to allow our other businesses freedom to continue

- Had to be good for our stakeholders

- Had to be a company with integrity

- Had to want to continue to grow

- Had to have family values

- Had to be a fair price

- Had to close by 12-31-12

So we kept on dancing. They asked for more information, and we provided it. We asked for more information and they did the same. Then came a tour of our offices and an audit of our books. Bottom line is that we kept moving – taking the next step in faith – waiting to see if God would close the door. But He didn’t. Things kept progressing and after Christmas it was a rush to getting things done. We finished it all around 2 PM on Dec 31. Hard to believe that two months earlier we were having our first meeting face to face.

God was faithful. He led the entire time. I spent many nights somewhat sleepless but always in prayer. He took the stress out of the process. When I would start to worry, I’d press closer to Him. He kept whispering to take the next step. Just trust Him. And I did. The rest, as they say, is history. Actually, I see it as “HIS Story” that He is writing in my life. So what’s next? Only God knew, and I was confident that He had a plan. I knew that He wanted me to experience fullness in life. (John 10:10) So I keep on moving and living for Him. (1 Corinthians 15:58) I’m excited about what God will do as we continue the journey together. He is faithful, and I just want to walk in obedience as He leads!

Now, some further insights from the HTS sale. It’s called the founders dilemma – the transition from a founder / entrepreneurial led company to one that is disciplined and professionally managed. This is a critical area for founders to pay attention to.

I do want to return to an area that I readily admit to being slow to execute. In the earlier part of this journey story, I mentioned the intent back in 2002 to name a president and change my role prior to the M&A march. John left right before that happened, and I didn’t take action on it effectively until 7 years later. I did make another run at it through an attempted acquisition which fell through, but it was in 2009 when I finally figured out what should have happened earlier.

That year, Scott Scrogin became president of HTG as we were in definite scale mode. He took a very small team and did a masterful job of bringing some control to the chaos that had built over the previous two years. He made the transition from being the Omaha location manager of HTS to HTG as part of his journey with us. That same year in the summer, Connie Arentson became the president of HTS after serving numerous roles since she joined back in the mid 90’s.

She too took over a less than structured team (which was and is my style for most things as I thrive on chaos and change) and began one of the most difficult changes a company has to make – moving from a founder led and entrepreneurial minded approach to being professionally managed by a business plan and budget. It was not a dream job to have to try and rein me in, and looking back, both she and Scott deserve kudos for putting up with my unbridled innovation and ideas.

THE most genius thing the HTG team did was get me to agree to the business plan and budget, and then give me three mulligans to use throughout the year. A mulligan was defined as something outside the business plan that required time, talent or treasure. That meant my idea flow needed to stop and only be presented when there was something I felt extremely strongly about and was willing to use one of the precious opportunities on. It didn’t guarantee it would be enacted, but it did provide a framework to control the disruption of new ideas.

That simple mind shift helped me control the never ending flow of ideas and caused me to go much further in thinking than I was accustomed to. I still had a few good ones that came to be through the mulligan process, but it allowed the team to have far more stability than dealing with my idea of the day, or hour, or minute when I would just let them roll out whenever they popped into my head. Seemed harmless to me, but it was disrupting to them. This was one of the best things we discovered together as a leadership team, even though it felt like it crimped my style at first.

So what did I learn from selling HTS……

Lessons from a Sale

- Have your legacy plan in place so you can evaluate options without emotion

- Be realistic about your expectations – understand the market

- Realize everything takes longer than it should

- Know that some of the biggest challenges are around vendor authorizations and distributor accounts

- Tax permits and government red tape are blockers to doing business

- Have your team in place to assist in evaluation and integration – CPA, Tax, Legal, Insurance, Banker

- Have a plan in place around who on your current team will be part of the process

- Know what stakeholders you will involve – family, investors, key customers

- Think through a communication plan well in advance of the close

- Go through benefits with a fine-tooth comb and communicate them clearly and often

- Talk to your employees face to face about the transition and have an FAQ prepared

- Make extra effort to listen to concerns and understand their fears

- Have little things like credit cards, payroll changes, and the like ready at close

- Do your due diligence, and then do it again

- Be prepared for surprises – they will come

- 1+1 does not equal 3 out of the gate most of the time, and may not equal 2 the first year

- Invest in your leadership so they are ready to step up and take over

- Be prepared for the emotions

- Know that others will question why you made the decision

- Forget about expanding the coverage or cross selling – focus on integration

- Culture is the most difficult thing to transfer so invest the time and do it well

- Don’t change any more than you have to and never say things are not going to change

- Listen to your advisors – if they say no – then don’t

- Listen to your spouse – if they have concerns – slow down and potentially stop

- Not every deal will work – it is not science as there are people involved

Those are some of the lessons I learned about selling a company. I think they still ring true today. Learn from others – you don’t have to make every mistake on your own!

We’ve been on the journey from entrepreneur to employee – a look at the SCCI/HTS story. As we wrap it up, I reflected on things I’ve learned over those years.

Not in any order, but here are some of the things I’ve learned over this 35-year trek:

- Never stop learning – the world never stops changing so to remain relevant we must continue to learn.

- Define your legacy plan – and keep it updated annually and communicated to internal and external stakeholders (including the team)

- Share your annual life plan – use it to provide understanding on personal priorities

- Develop a leadership plan – we all need to continue to grow our leadership skills

- Get involved with peers – you need perspective beyond your own bubble

- Find out what good looks like – benchmark with others to learn best in class metrics

- Think big – and then get to work making it a reality

- Don’t listen to the naysayers – they will always be there no matter your success

- Hire the right people – and don’t wait too long to do it because people are the business

- Expect plateaus as growth is a series of them – and craft a plan to break through them

- Failure is part of leading and learning – do it quickly, learn and move on

- Leverage partnerships – they can be a vital part of growing

- Taking risk is part of running a business – but you need to measure and understand it

- Entrepreneurs need to control their idea flow – too many can overwhelm the team

- M&A is an effective growth engine – but you need to know why you are using it

- Don’t merge with another company unless you need specific talent – acquisitions are usually the right approach

- It is easier to take on partners that remove them – don’t dilute equity without a good reason

- Don’t involve anyone in M&A activities that are not required – less is more as long as the work gets done

- Take decisive action on colleagues that don’t fit your culture – the rest of the staff is wondering what is taking so long

- Transition M&A to the go forward org as soon as possible – don’t drag out the transition as customers don’t care and employees will never be ready

- Don’t spend all your available money on an M&A deal – you need some (25% of the total deal price) available for integration

- NEVER use your working capital to do an acquisition – you will struggle to meet operational cash needs if you do

- Cash is always king – manage it wisely and daily

- You can’t run a company without real time data – develop systems to provide accurate daily reporting

- Develop a strong external support team (legal/CPA/banking/insurance/financial mgmt) – empower them to veto actions

- Have a clearly defined mission, vision and core values – make sure everyone on the team knows them

- Culture must be protected and cultivated – it is the hardest thing to create, especially through M&A

- Listen to your spouse – they often have insight and perspective you will miss

- Have a well defined strategic plan – and communicate it clearly to the team

- Create an annual business plan and budget to guide the company – aligned to the legacy and strategic plan updated annually and measured at least monthly

- Expect the unexpected – you can’t prepare for every possibility but you need contingency plans in place

- Empower people – you are the bottleneck unless you do

- Document and verify – write things down and make sure others do as well

- Allow locations some autonomy in their expression of culture – don’t force cookie cutter culture but allow some local interpretation

- Expect people to struggle with change – and prepare for some to exit as a result

- Communicate far more than you think necessary – and do it in as many different ways as possible

- 1+1 seldom equals 3 – and certainly doesn’t typically right out of the gate

- Business model transformation is difficult – don’t underestimate the cost of time, talent and treasure to make a change

- Stay in your lane – or hire the right people to move into a new area of business

- Have discipline around meetings with specific purpose – ownership, leadership, management, teams, all hands, 1:1

- Always be planning for exit – you can’t take the company with you so get ready

- Run the company like you might sell it at any time – keep your books clean and ready for inspection

- The people that got you where you are likely can’t take you where you want to go – a difficult reality to prepare for

- Have a list of non-negotiables for transition – you need to have a way to take emotion out of the decision

- Be realistic in your expectations – know the market situation and be realistic if you want to exit

- You can’t get the company prepared for exit quickly – you need three years to truly get it right so plan ahead

- Fair does not mean equal – particularly when considering family transitions

- Transitioning from founder led to professionally managed is difficult – but it is vital to continue growth

- Know the industry you serve – and prepare to changes and trends you see coming

- Get involved on advisory councils and other groups – gather broad input of information

- Learn to leverage vendor relationships – they can accelerate growth and profitability

- We are in the relationship business – no matter what we sell or service, it is really all about people

- Leverage tools to provide efficiency – don’t just throw people at problems, ask if there is an automated or better way

- Don’t chase shiny objects – have a disciplined approach (committee or team) to new ideas

- Continue to innovate – change is essential to remain relevant

- Look for ways to disrupt the market – there is always opportunity

- Know your personal purpose in life – you need to be able to answer the questions ‘why’

- Don’t separate your faith from work – it will lead you down the wrong path

- Check your ego – and have people around you that will be honest in warning you if it gets out of control

- Be transparent – let people know you and earn trust

- Run open book management – the team can’t manage without real numbers

- In the absence of information people make things up – and that is usually much different than the truth

- Make sure you are validated outside work – it must not become the reason you live

- Never say ‘nothing will change’ – that will come back to haunt you because change happens

- Create listening posts and truly listen – to customers, vendors, colleagues, other resources

- Have a plan with key vendors – annual joint planning with gives and gets for both sides

- Know what you will do after exit – you can’t play golf all day every day

- Don’t wait too long – when you are out of gas, find a way to exit

- Replenishment is important – you have to know what works for you and be disciplined to replenish

- God is always in control – no matter what the circumstances or situation, He is on the throne

So there are 70 lessons – two for every year of the 35 year journey. I learned a lot more but this is enough for today.